north carolina real estate taxes

Taxation of real estate must. The Local Government Division provides support and services to the counties and municipalities of North Carolina as well as taxpayers concerning taxes collected locally by the counties and.

How Do State And Local Property Taxes Work Tax Policy Center

However in the case of a transfer of ownership North Carolina Session Law now transfers the.

. Annual tax bills are calculated for the fiscal taxing period of July 1 through June 30. Jobs Local US Jobs Register Advertisers Online Edu TOEFL. The Davidson County Tax.

Wayne County Tax Collector PO. 910-989-5818 Hours Monday - Friday 8 am. Box 1495 Goldsboro NC 27533.

3 Programs Providing Relief From Property Taxes In North Carolina. 1 be equal and uniform 2 be based on up-to-date market value 3 have a single estimated value and 4 be considered taxable if its not specially exempted. Real estate and personal property listed for taxation during January are billed in July and may be paid on or before August 31 to receive a 12 discount.

List Appraise Assess and Collect taxes for all real property personal property and motor vehicles. Tax Office 234 NW Corridor Boulevard Jacksonville NC 28540 Phone. Real estate taxes are generally the legal obligation of the owner of record as of January 1.

ANNUAL REAL ESTATE PERSONAL PROPERTY AND POLICE SERVICE DISTRICT TAX. Post real estateproperty jobs for free. 2021 ADVERTISEMENTS OF TAX LIENS FOR NON-PAYMENT OF 2021 TAXES ON REAL PROPERTY BY DAVIDSON COUNTY.

The tax lien or assessment date each year is January 1st. Copyright Burke County North Carolina Tax Commissioner. Apply online for Finance Property Tax Analyst job North Carolina USA.

Statements for real estate business and personal property may be printed using our Online Tax Bill Search. The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. Hosea Wilson County Assessor Tax Appraisal Office 2524755940 Fax.

Click below to view listing. List Appraise Assess and Collect taxes for all real property personal property and motor vehicles as required by and in accordance with the General Statutes of North Carolina while. Taxes must be paid on or before.

The property tax in North Carolina is a locally assessed tax collected by the counties. Tax amount varies by county. See South Carolina Code 12-43-217 and 12-37-3120 through 12-37-.

Taxes are due and payable September 1st. Taxes SEARCH AND PAY TAXES. Becky Huff Tax Collector 2524755954 Fax.

The Low Income Senior Property Tax Relief Program the Disabled Veterans Property Tax Relief. North Carolina has one of the lowest. Payments Please send payments to.

Department of Revenue does not send property tax bills or collect property.

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

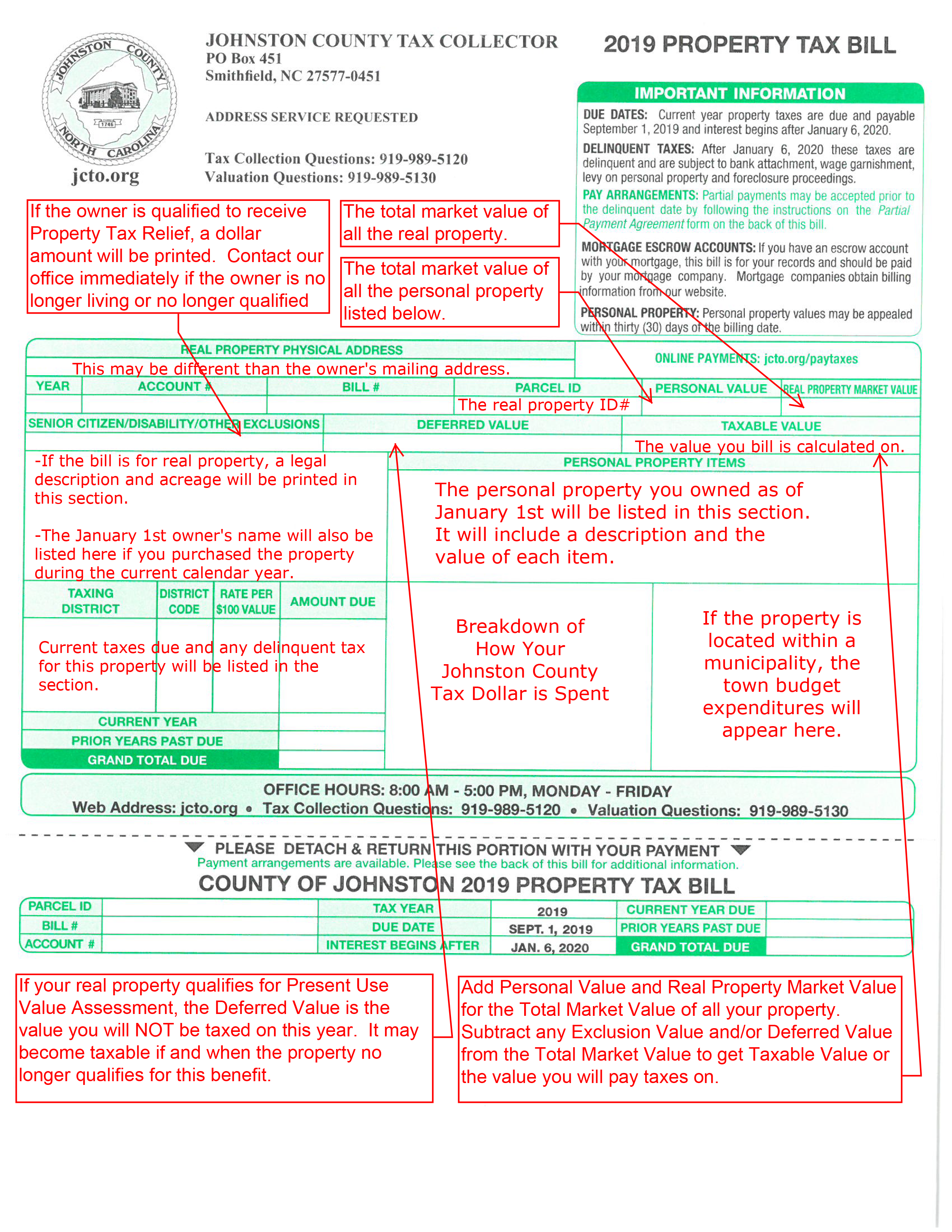

Johnston County North Carolina Tax Administration

How Do State And Local Property Taxes Work Tax Policy Center

Information On Charlotte Nc Area Property Taxes Henderson Properties

Real Property Division Henderson County North Carolina

Tax Administration Duplin County Nc Duplin County Nc

North Carolina Tax Sale Basics Tax Deed Foreclosure Overview Youtube

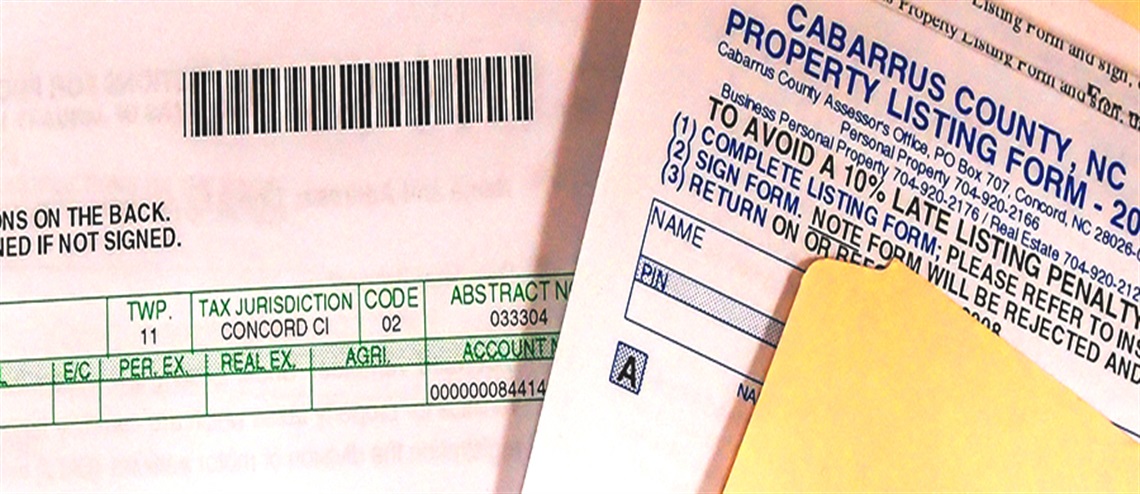

Tax Administration Cabarrus County

Disabled Veteran Property Tax Exemptions By State And Disability Rating

Free North Carolina Small Estate Affidavit Form Aoc E 203b Pdf Eforms

Here S Why Gaston Has A High Property Tax Rate

Real Estate Wake County Government

Incredible Tax Breaks For Homeowners In North And South Carolina

Your High Point North Carolina Real Estate Questions Answered

Property Tax In North Carolina

How North Carolina Stacks Up In Property Tax Comparisons Triangle Business Journal